What Is The Bonus Depreciation For 2024

What Is The Bonus Depreciation For 2024. Phase down of special depreciation allowance. Bonus depreciation is a valuable tax incentive that allows businesses to deduct a significant portion of the cost of eligible assets upfront, rather than writing them off incrementally over their useful life.

First, bonus depreciation is another name for the additional first year depreciation deduction provided by section 168 (k). The legislation, dubbed the tax relief for american families and workers act of 2024, extends 100% bonus depreciation for eligible qualified property for qualified property placed in service after december 31, 2022, and before january 1, 2026 (january 1, 2027, for longer production period property and certain aircraft [1].)

Bonus Depreciation Is A Valuable Tax Incentive That Allows Businesses To Deduct A Significant Portion Of The Cost Of Eligible Assets Upfront, Rather Than Writing Them Off Incrementally Over Their Useful Life.

The bill delays the beginning of the phaseout of 100% bonus depreciation from 2023 to 2026.

Guide To Depreciating Assets 2024.

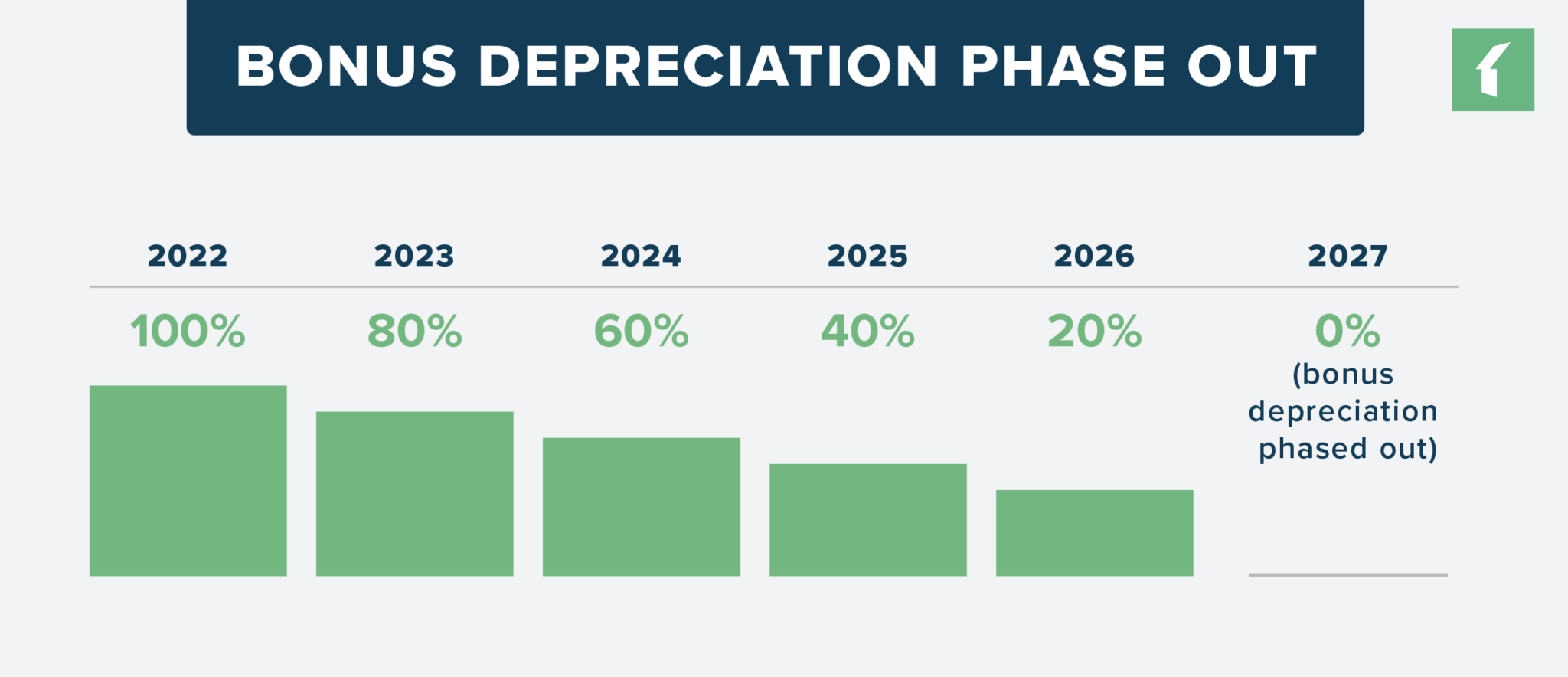

The allowable percentage is set to decrease in 20% increments every year through 2027, meaning bonus depreciation is set at 60% for 2024, 40% for 2025, and 20% for 2026 until the current provision expires and drops to 0% in 2027.

As A Small Business, 100% Bonus Depreciation Applies In Some Scenarios.

Images References :

Source: mufiqvalentine.pages.dev

Source: mufiqvalentine.pages.dev

Business Vehicle Bonus Depreciation 2024 Brana Brigitte, Bonus depreciation:100% bonus depreciation is extended through 2025, allowing businesses to fully expense qualified property. The bonus depreciation rate decreased to 80% in 2023 and will continue to decrease by 20% each year until it is zero for property placed in service after december 31, 2026.

Source: sailsojourn.com

Source: sailsojourn.com

8 ways to calculate depreciation in Excel (2024), Finally, not all leasehold improvements will qualify for bonus depreciation, even if they meet the basic criteria. The full house passed late wednesday by a 357 to 70 vote h.r.

Source: www.buildium.com

Source: www.buildium.com

Bonus Depreciation Saves Property Managers Money Buildium, Bonus depreciation is a valuable tax incentive that allows businesses to deduct a significant portion of the cost of eligible assets upfront, rather than writing them off incrementally over their useful life. The bill delays the beginning of the phaseout of 100% bonus depreciation from 2023 to 2026.

Source: www.madisoninvesting.com

Source: www.madisoninvesting.com

How to Maximize Your Tax Savings When is Bonus Depreciation Phasing Out?, First, bonus depreciation is another name for the additional first year depreciation deduction provided by section 168 (k). This is down from 80% in 2023.

Source: www.bestevercre.com

Source: www.bestevercre.com

Depreciation and Bonus Depreciation Everything You Need to Know, Additionally, there is no business income limit, so you can use this deduction even if you plan to report a loss for the business. As the nation is still reeling from the shock of the recent sk matka scandal, the indian government is taking measures to ban the game permanently.

Source: www.pinterest.com

Source: www.pinterest.com

Bonus Depreciation What It Is and How It Works Tax help, Financial, The last time the company had issued bonus shares was in 2018, when it. For example, if you purchase a piece of machinery in december of 2023, but don’t install it or start using it until january of 2024, you would have to wait until you file your 2024 tax return to claim bonus depreciation on the machinery.

Source: investguiding.com

Source: investguiding.com

Bonus Depreciation vs. Section 179 What's the Difference? (2024), However, as of tax year 2023, bonus depreciation was reduced to 80%. You may also see this deduction.

Source: bluebridgefinancial.com

Source: bluebridgefinancial.com

What You Need To Know About Depreciation in 2024, First, bonus depreciation is another name for the additional first year depreciation deduction provided by section 168 (k). July 16, 2024 has been set as the record date for payment for issue of bonus shares, subject to approval of shareholders.

Source: www.bank2home.com

Source: www.bank2home.com

Bonus Depreciation Calculation Example Ademolajardin, The senate holds the keys to whether the bill advances, and in what form. Continuation of 100% bonus depreciation.

Source: business2news.com

Source: business2news.com

What is Bonus Depreciation?, Please explain “used property” as it relates to bonus depreciation. The bonus depreciation deduction limit for the 2023 tax year is 80% of the asset cost, down from 100% in 2022.

Additionally, There Is No Business Income Limit, So You Can Use This Deduction Even If You Plan To Report A Loss For The Business.

The legislation, dubbed the tax relief for american families and workers act of 2024, extends 100% bonus depreciation for eligible qualified property for qualified property placed in service after december 31, 2022, and before january 1, 2026 (january 1, 2027, for longer production period property and certain aircraft [1].)

How To Download A Copy Of The Guide To Depreciating Assets.

You may also see this deduction.